All Categories

Featured

Table of Contents

- – What do I need to get started with Wealth Buil...

- – How secure is my money with Infinite Banking A...

- – How do I leverage Infinite Banking In Life In...

- – How do I track my growth with Wealth Manageme...

- – How does Generational Wealth With Infinite B...

- – Is Life Insurance Loans a good strategy for ...

We use data-driven techniques to evaluate financial products and services - our evaluations and rankings are not affected by advertisers. Unlimited banking has caught the rate of interest of many in the individual financing globe, promising a course to monetary flexibility and control.

Infinite banking refers to an economic strategy where a specific becomes their very own banker. The insurance holder can obtain versus this cash worth for various monetary demands, successfully lending cash to themselves and repaying the policy on their very own terms.

This overfunding speeds up the development of the policy's money worth. Boundless financial uses several benefits.

What do I need to get started with Wealth Building With Infinite Banking?

Here are the response to some questions you might have. Is unlimited financial legitimate? Yes, boundless financial is a reputable approach. It involves utilizing an entire life insurance policy plan to develop a personal funding system. Its effectiveness depends on different aspects, including the plan's framework, the insurance policy firm's efficiency and just how well the approach is managed.

The length of time does boundless financial take? Infinite financial is a long-lasting strategy. It can take a number of years, commonly 5-10 years or more, for the money value of the policy to expand adequately to start borrowing versus it successfully. This timeline can differ depending on the plan's terms, the premiums paid and the insurance policy company's efficiency.

How secure is my money with Infinite Banking Account Setup?

As long as costs are present, the insurance holder merely calls the insurance provider and requests a car loan versus their equity. The insurance firm on the phone will not ask what the lending will certainly be used for, what the revenue of the customer (i.e. policyholder) is, what other properties the individual may need to act as collateral, or in what timeframe the person intends to pay back the loan.

In comparison to describe life insurance items, which cover just the beneficiaries of the insurance holder in the occasion of their fatality, whole life insurance covers a person's entire life. When structured effectively, whole life policies produce an one-of-a-kind income stream that raises the equity in the policy over time. For more reading on exactly how this works (and on the pros and cons of whole life vs.

In today's world, globe driven by convenience of consumption, usage many as well several granted our approved's country founding principlesStarting concepts and justice.

How do I leverage Infinite Banking In Life Insurance to grow my wealth?

It is a concept that permits the policyholder to take lendings on the entire life insurance policy. It ought to be offered when there is a minute financial problem on the person, where such car loans might aid them cover the economic lots.

The policyholder requires to connect with the insurance coverage business to request a loan on the plan. A Whole Life insurance coverage policy can be called the insurance coverage product that supplies protection or covers the person's life.

The plan may need regular monthly, quarterly, or yearly payments. It starts when a private occupies a Whole Life insurance policy. Such plans might purchase corporate bonds and government safeties. Such plans retain their worths as a result of their traditional approach, and such plans never buy market tools. Limitless financial is a principle that permits the insurance policy holder to take up financings on the whole life insurance plan.

How do I track my growth with Wealth Management With Infinite Banking?

The cash money or the surrender worth of the entire life insurance policy works as collateral whenever taken financings. Expect a private enrolls for a Whole Life insurance policy policy with a premium-paying regard to 7 years and a plan period of two decades. The private took the plan when he was 34 years old.

The security obtains from the wholesale insurance coverage policy's money or surrender value. These factors on either extreme of the spectrum of facts are talked about below: Unlimited banking as an economic technology improves cash money circulation or the liquidity profile of the insurance policy holder.

How does Generational Wealth With Infinite Banking create financial independence?

The insurance plan car loan can also be readily available when the individual is out of work or encountering health problems. The Whole Life insurance coverage policy preserves its overall value, and its efficiency does not connect with market efficiency.

In enhancement, one must take only such plans when one is financially well off and can take care of the policies premiums. Boundless financial is not a rip-off, yet it is the finest thing a lot of people can opt for to enhance their economic lives.

Is Life Insurance Loans a good strategy for generational wealth?

When individuals have infinite financial explained to them for the initial time it appears like an enchanting and risk-free way to grow wide range - Infinite Banking wealth strategy. The idea of replacing the despised financial institution with loaning from on your own makes so much more feeling. Yet it does call for changing the "disliked" bank for the "disliked" insurance provider.

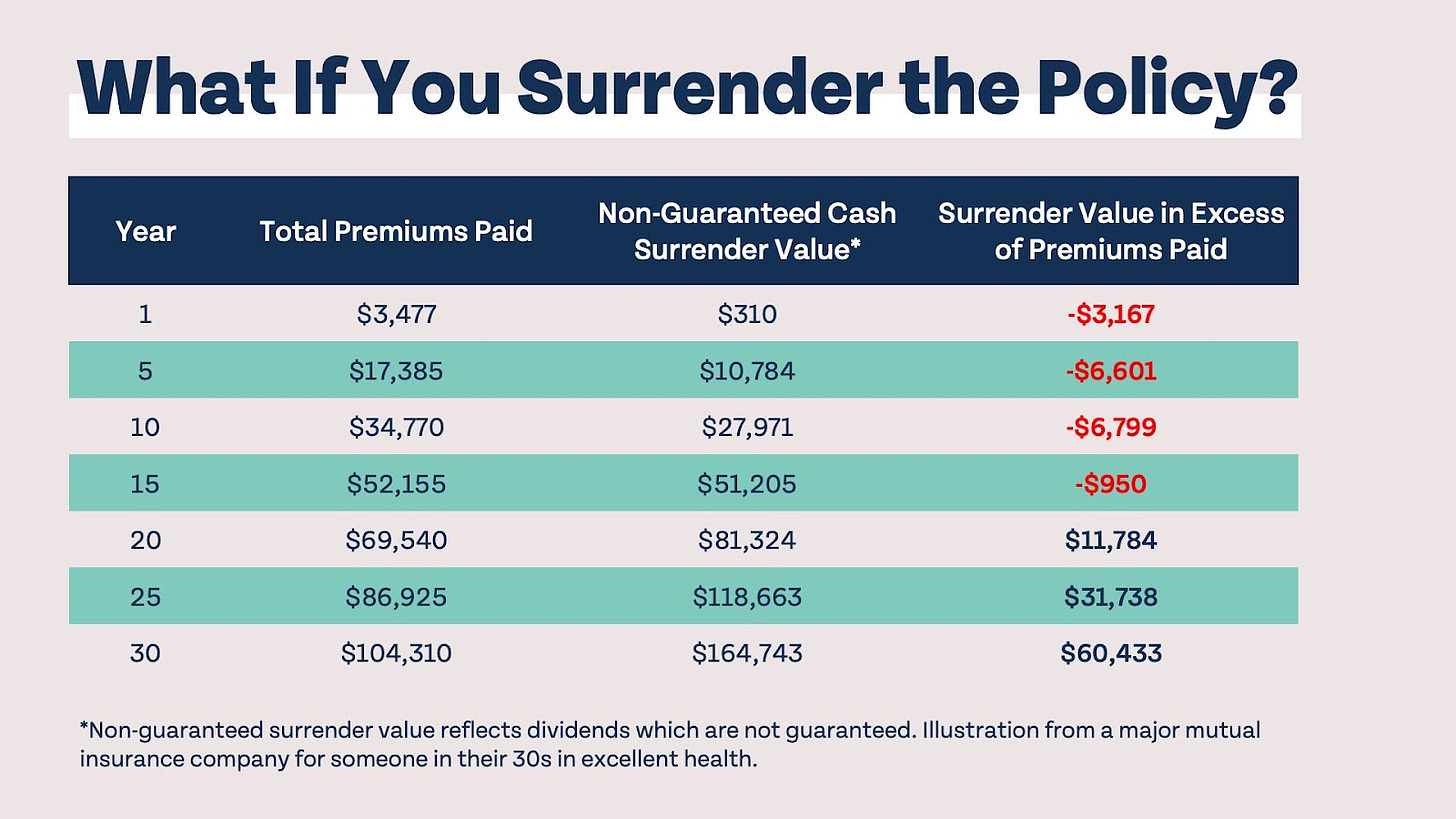

Obviously insurance coverage firms and their representatives like the idea. They developed the sales pitch to sell even more entire life insurance policy. But does the sales pitch live up to actual world experience? In this write-up we will initially "do the mathematics" on infinite financial, the bank with yourself ideology. Due to the fact that followers of unlimited financial may declare I'm being prejudiced, I will use screen shots from a supporter's video and connect the whole video clip at the end of this write-up.

There are no products to buy and I will certainly sell you absolutely nothing. You keep all the cash! There are 2 major monetary catastrophes built into the boundless financial concept. I will expose these defects as we overcome the mathematics of how unlimited banking actually works and how you can do far better.

Table of Contents

- – What do I need to get started with Wealth Buil...

- – How secure is my money with Infinite Banking A...

- – How do I leverage Infinite Banking In Life In...

- – How do I track my growth with Wealth Manageme...

- – How does Generational Wealth With Infinite B...

- – Is Life Insurance Loans a good strategy for ...

Latest Posts

How To Take Control Of Your Finances And Be Your Own ...

What Is Infinite Banking Concept

Personal Banking Concept

More

Latest Posts

How To Take Control Of Your Finances And Be Your Own ...

What Is Infinite Banking Concept

Personal Banking Concept